Taking a major decision for clients, from college savings to retirement plans, takes the responsibility of saving, protecting, investing, and lending the greens in our society. Bankers are part of the base foundation in our world. It’s a job of such high importance and holds universal respect for anyone in this position. If your ultimate goal is to be a bank manager, look further.

This article will assist you step-by-step in becoming a bank manager right after you graduate high school.

Step 1: Setting your mind and Understanding the position

While becoming a Bank Manager is a well-settling and rewarding job, you’ll have to undergo a series of challenges like qualifications and job experiences that require time and hard work. So, you must find the reasons for taking this job that will drive you to your goal. Asking questions like:

Why do I want to be a Bank Manager?

What is my purpose in aiming for this position besides monetary and prestigious benefits?

Why would I fit for this position?

Is there any other job I’m interested in?

If the answers are positively directed towards taking this job, then congratulations! You are on the right track.

But there is one more question you must ask yourself, Do you know what a bank manager has to do? What is the pay like? The standard facts about a bank manager should be well-versed before you make an educated decision.

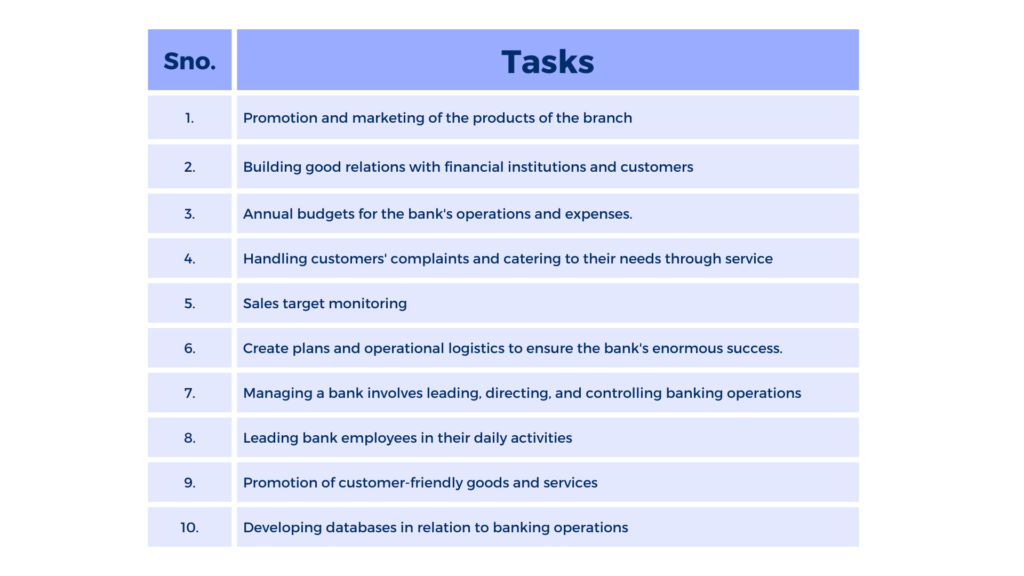

Below is a concise table consisting of the fundamental roles and responsibilities of a bank manager:

If you are on board with these tasks, then you are good to go for the next step.

Step 2: Qualifications and Eligibility

College Degree

Undergraduate Degree

The basic qualification to start your journey would be a bachelor’s degree in the field of Finance, Banking, or Commerce.

Some of the well-known and recognized degrees are as follows:

- Bachelor of Business Administration BBA: 2-year management course covering managerial, hospitality, and entrepreneurial requirements.

- Bachelor of Commerce (B.com): 3-year degree in accounts, management, economics, business communication

- BCom in Taxation and Finance: 3-year degree specializing in taxation and finance management.

Postgraduate Degree

Once you complete your undergrad degree, you can opt for a post-graduate degree to enhance your skills and increase your chances of bagging a job.

- Masters of Commerce (M. Com): 2-year degree catering to specific knowledge in managerial skills in related industries, businesses, and banks.

- Master of Business Administration (MBA): 2-year degree catering to in-depth knowledge in business and managerial ethics.

Addiontial Qualification Advised

Exams like Bank PO, IBPS, RRB, etc give an additional benefit for beneficial allowances, facilities leaves along with salary. It is advised that you prepare and give such exams whilst you pursue your college degree.

You could also look for courses that are in-trend and required for the position you’re aiming for through professional banking associations like Banking Administration Institute, Mortgage Bankers Association, etc.

Step 3: Work Experience and Job

Work Experience

It is necessary to have at least 2 years of work experience before you apply for a job position. Internships and part-time jobs offline/online are the perfect way to gain such experience and add on to make a pleasing resume and portfolio.

Myth Buster Break

Bank manager is mistaken for being a one-entry job position. That’s not the case with such jobs since it’s not a job you immediately get rather you need to work your way up from being an intern in your job to being promoted as a bank manager for office, districts, regions and so on.

Job Application

Addiontial Qualification Advised

It’s crucial to list down your qualifications and experiences with certification proof with a list of your introduction, skills, and referral contact when you prepare your CV.

In the times of the internet, it has become easier to apply for jobs. Using search bars to apply for job applications including signing up for apps specified for jobs like LinkedIn, and Upwork increases your chances of securing jobs.

Note: Always prepare and tailor your CV according to the needs of the organization you are applying for.

Other successful means: Networking

Apart from applying, the organic way of landing in a bank manager position is to contact and connect with people currently holding that position; Bank Managers. So, if any position opens up, you will be the first person they would think of hiring.

Such contact can create online by joining Facebook or LinkedIn groups or going to workshops and events to interact and put a good word about yourself.

Step 4: Long Term Securement

When you secure your job position, you must understand that this is not the end to your journey. There is always room for learning and improving to keep your position consistent or event get promoted to higher level.

Training Programs

Many organizations and bank would make you undergo through a mandatory training program when you are a newbie. Keep that practice going. Take up training programs provided by your workspace to understand the current market and enhance your skills for a smoother and efficient work performance.

As a Bank Manager you are showered with multiple benefits, with an excellent pay along with a respectable position not only in your workspace but in society. Becoming one is a tedious and time-consuming path to go through but always remember your aim and purpose of choosing this journey, this will help you stay consistent and motivated to experience a fruitful journey.